Stripe excels at handling online transactions and recurring payments. The platform gained a wide adoption and trust in the last decade. However, what if your business resides in a country that is not currently supported?

- Disclaimer

- Crucial Role of a Physical Business Address

- Stripe’s Global Footprint: Bridging the Gaps

- What if I am a freelancer?

- Opening a Bank Account with Wise

- Wise and the Likes

- Payouts to Multiple Bank Accounts

- Summary

Disclaimer

This article is not sponsored, nor am I affiliated with Stripe or any other company mentioned in this post. I give you my honest opinion from a technical perspective. Please do your own research regarding legal and financial implications.

Crucial Role of a Physical Business Address

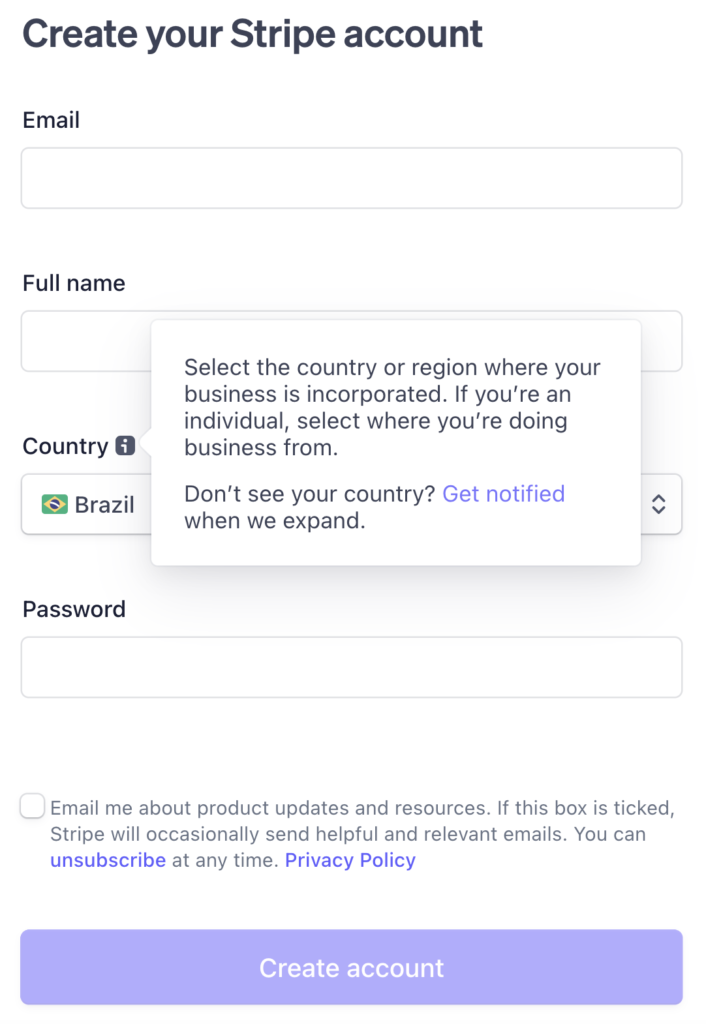

Let’s say you are a startup looking for an efficient way to automate your cash flow. Or perhaps you’re a freelance writer and in order to join a partner program on Medium a Stripe account is a must. Whatever the reason, Stripe goes above and beyond to get you onboard. One rule that is not negotiable is your business address. While there is a growing list of supported countries, large parts of the world are still not covered.

Just to make it clear, this is not about holding a bank account in the right currency, such as US dollars. It is the physical address that matters and a PO box is definitely not enough.

Physical location of business: We will confirm the physical address of your business.

Stripe: business verification

Fun fact, you can sign up with Stripe without providing bank account details. Obviously, you will want to register a bank account (in a supported currency) in order to receive payouts. All to say, it is your business location that matters the most. Your entire Stripe account is tied to a single country. If your business has a branch in another country, then you need a separate Stripe account for that too.

Stripe’s Global Footprint: Bridging the Gaps

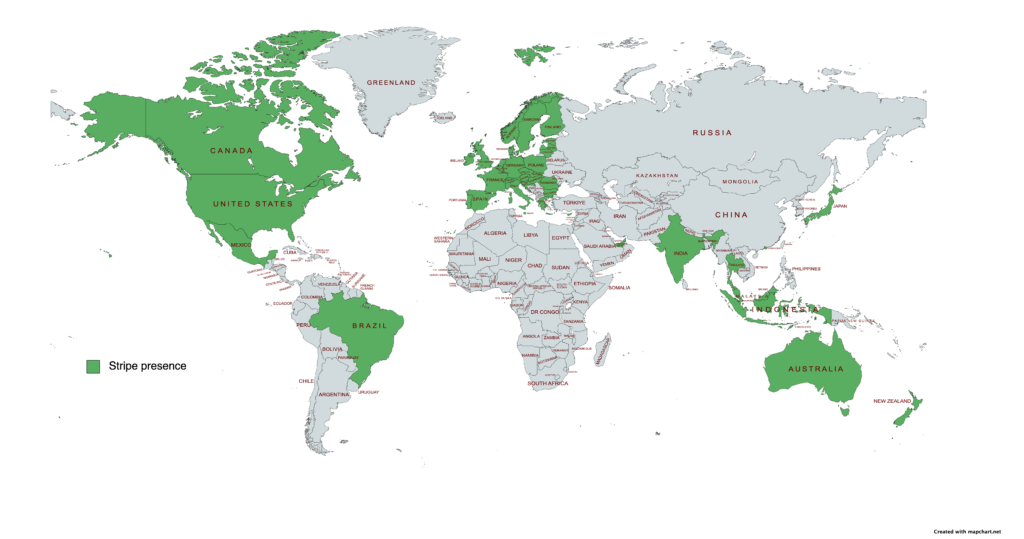

Stripe currently supports 46 countries. Businesses in the US and Canada, Australia, New Zealand, Ireland or the United Kingdom are first-class citizens. Stripe has a fairly strong presence in Europe as well, but there are still some countries left out. Residents in the United Arab Emirates, Brazil, India and a handful of countries in Asia can benefit from Stripe too. No African country is supported.

If you want to sign up with Stripe and your country is not listed are you out of luck? Nope. All you need to do is to set up a business entity in one of the countries on the list, preferably in the US. Assuming you are a startup or even an individual an LLC (limited-liability company) is the most suitable choice.

There are many online services that let you start a US business as a non-US citizen. If you don’t mind spending $500 for opening an LLC in Delaware you can use Stripe’s own platform called Atlas. Otherwise, there are plenty of other options. Here are some of them.

The service providers below let you open a business in just about any US state, have flexible pricing plans and a good rating on TrustPilot.

I highly recommend you to read this awesome article by David Nwaeze who gives an in-depth guidance on registering a US business if you come from a country that is not supported by Stripe, Nigeria in this case.

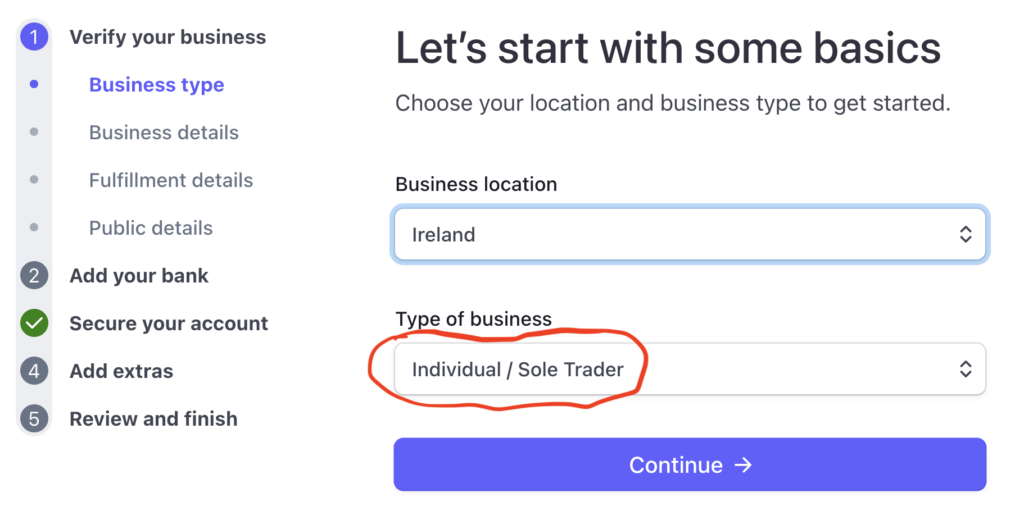

What if I am a freelancer?

Well, you still need to register as a company. Stripe does support individual accounts, but only for those who are residents in one of the listed countries. Everyone else has to open a business as outlined above.

Next, you need a bank account in order to receive payouts from Stripe.

Opening a Bank Account with Wise

I love Revolut for its ease of use and favourable exchange rates. Unfortunately, my IBAN can only receive international payments and Stripe requires a local bank account. In order to use Revolut with Stripe I would have to upgrade to a business plan.

As always, there are alternatives. Opening an account with Wise is one of them. On their blog Wise suggests that while they are not a bank their product can be used as a local bank account in up to 30 countries, including the US.

You’ll also get local bank details for up to 10 currencies — including USD, GBP, EUR and more, to receive convenient local payments from 30+ countries

Wise as a bank account

The Wise account allows you to send and receive money, which is pretty much all you need.

.. you’ll get some features which are similar to those available from regular bank accounts, such as the option to hold a Balance, send and receive payments, and spend with a linked card.

Wise account has basic features of a bank account

Wise and the Likes

Your options certainly don’t end with Wise. There are several fintech technologists ready to equip you with a local bank account. These are the ones I am aware of now and I am sure the list will grow in the future.

- Wise

- Payoneer

- Revolut (Business plan)

- Silverbird

- N26

Opening a virtual bank account lets you work around the limitations of your geolocation. The downside is a potentially higher rate of failed transactions. Watch out for these and get in touch with Stripe support in case of issues.

You can use a virtual bank account (such as N26, Revolut, Wise, and so on) as your Stripe payout account. While Stripe supports non-standard bank accounts, you may see higher payout failures for these accounts.

Stripe payouts (shortened)

Payouts to Multiple Bank Accounts

You can register several bank accounts and handle payments in different currencies. This allows you to avoid costly currency conversions.

For example, my Stripe account is tied to my resident country, the Czech Republic. I use my local bank account which makes Czech crown (CZK) my default currency. Suppose, I have a customer in Sweden and invoice my work for them in their local currency (SEK). Since I don’t hold a Swedish account, Stripe will automatically convert all incoming payments into my default currency. The conversion won’t cost me nearly as much as it would had I used a brick-and-mortar bank service, but there is still fee I pay for each and every transaction. Now, say I have another customer in Germany and all invoices are obviously settled in Euros. Well, since I have a Euro bank account I simply add it in Stripe. Every time I receive a payment in Euros Stripe transfers the amount directly to my registered account without any conversion.

Last but not least, payouts can take anything between two business days to a week and daily proceedings are, again, determined by your Stripe account’s country. For instance, Stripe users in Brazil enjoy automatic daily payouts, while in Japan daily payouts are not available. In some countries Stripe gives an possibility of instant payouts, but this is currently subject to a 1% transaction fee.

Summary

Don’t despair if you reside in a country that is not serviced by Stripe. Setting up a US business entity is doable and relatively cost efficient. Registering a virtual bank account is even cheaper and perfectly legitimate. There is a growing service industry aimed at those who are deprived access to platforms like Stripe.

Thanks for reading and all the best with your business in the global economy.